DYI Comments: Since the beginning of our hydrocarbon economy we've endured two major oil shocks; peaking in December of 1979 and June of 2008. The former was the cause (along with other problems) of the inflationary 70's and poor economic growth. The latter was the cause(along with other problems as well) of our massive downturn.

End of a Romantic Era...Cheap Oil!....Remember when Exxon was Exxon and Mobil was Mobil?? The world was awash with cheap oil which means cheap gas during the late 1990's. November 30, 1999 the merger was officially penned into place to create the energy giant ExxonMobil Corporation. Nothing sinister at the time both companies needed to consolidate and eliminate duplication in order to maintain their dividend stream without this merger massive dividend cuts (possible elimination) would have occurred. The American public went into their second love affair(1960's the first) with gas guzzlers with the Hummer as its poster child.

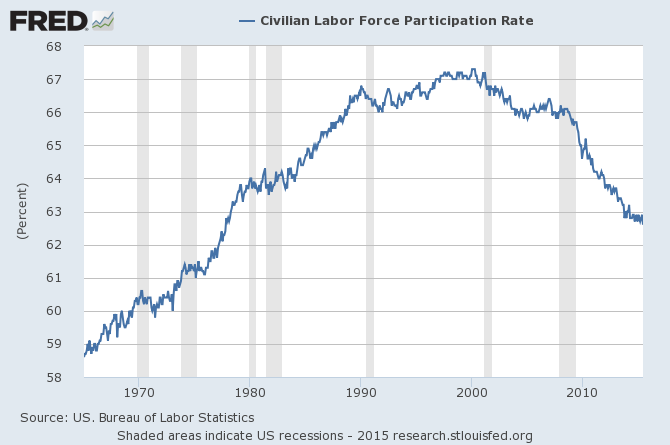

From that point on the cost of oil was to move up at a relentless pace over the next 115 months from a inflation adjusted bottom(Dec 98) of $12.45 per barrel to its peak in June of 2008 at $136.31. Those 115 months is a annualized return rate of 21.02%! The Great Economic Downturn began on December 1998 with the end of cheap oil and its effect on employment as shown by the chart below.

The 2000-2002 downturn didn't pass the smell test of a typical cyclical business downturn. As our economy despite heroic(misguided policies) measures by our central bank and politicians with fiscal spending job creation programs. The civilian labor force (the real taxpayers) continued to go south as oil prices maintained an elevated price despite a small short term drop during that recession. All of the government programs and the beginnings of the Fed's sub atomic low interest rates only covered upped the on going downturn.

The Great Economic Downturn part II....As many have labeled The Great Recession extreme high oil prices was the trigger that ended the economic cover up as described. As we all know so well real estate prices were smashed along with stocks and corporate bonds.

Plus oil prices.

Only to see them recover once again. Then the big drop but at a price significantly higher than the Romantic Era of 1998 as our hydrocarbon based economy continues to be under pressure(at a lesser rate). Job creation is not doing as well as the main stream press would have you to believe. Only when the Boomers begin to retire in significant numbers will our labor participation rate improve. This will be a demographic based recovery and whoever is lucky enough to be President in the 2020's will take the bows for inspired leadership.

Currently the U.S. stock market despite its turbulent market action continues to be at nose bleed valuations. On a relative basis lower oil prices are holding up the elevated prices. The reflation trade is in effect by an aggressive central bank. As time moves forward and the positive effects of lower oil prices wears off valuations will come back into play.

The Oil Indicator

9/1/15

Updated Monthly

Updated Monthly

Oil Prices: 9/2/14.....$97.06

8/28/15...$49.61 DOWN 49%

(oil prices approximately one year earlier due to weekends & holidays)

(oil prices approximately one year earlier due to weekends & holidays)

As of 8-28-15 oil prices from a year earlier are down 49% as stated before, time moves forward the percentage drop will be reduced along with the effect upon stock and bond markets (valuation will take over).

For whatever it is worth December 1998 will be a watershed moment for social and economic historians as it will be marked as the beginning of the end of suburban sprawl. Those making the long commute into the city for the higher wages is slowly ending. Despite the higher real estate costs(renting or buying) fuel, maintenance, and financing cost have outweighed the lower cost in the outlining communities. Despite hybrid or full electric vehicles only extends our reliance on fossil fuels but no game changers.

AN END OF AN ERA....

I'm not suggesting these communities will turn into your next ghost towns only that the lopsided building of suburbia has ended. This internal diaspora will take place over the next 30 years as urban centers with demanded excellent mass transit will be the preferred place to live. By the time we get there as a society most will think it always was this way.

My model portfolio has not changed....Very defensive as valuations are sky high with future returns being dismal at best and losses at their worst over the next 10 years.

Updated Monthly

No comments:

Post a Comment