From

Global Recession Could Occur if Oil Price Drops Again

If oil prices take another dramatic slide, as I believe they will, who wins and who loses? And could plummeting oil prices sow the seeds of the next recession ?

Oil-importing countries are obvious winners from falling crude prices. That includes the U.S., where -- despite a surge in domestic production -- imports still account for nearly 50 percent of petroleum consumption. The net oil-importing countries of western Europe and Asia also benefit from falling crude prices. India and Egypt, which subsidize domestic energy use, will surely benefit. Some of that, however, will be offset because crude oil is priced in U.S. dollars, and those countries' currencies have grown weaker against the greenback.

"The windfall for U.S. consumers is considerable, with average gasoline prices down 24 percent to $2.47 a gallon from $3.77 in June 2014. No doubt, prices will fall even more when the summer driving season ends after Labor Day."

Most forecasters believe consumers will spend the windfall, and thus boost the economy.

"But almost all of the savings from lower pump prices so far have been used to rebuild household assets and reduce debt. Consumers tend to increase their savings in tough times;"

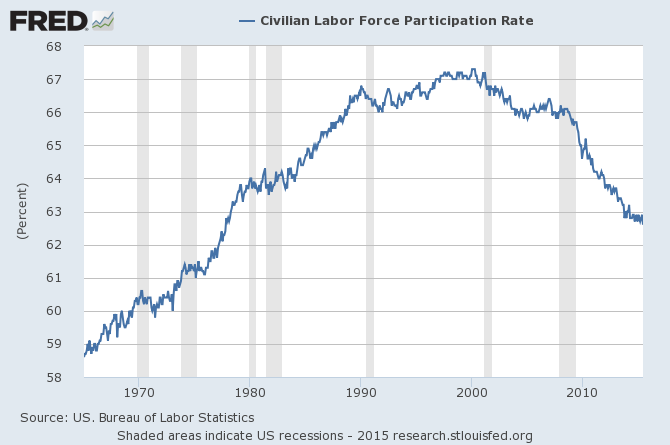

they've been doing so during the six-year recovery, even as real wages and median household incomes remain flat.

Lower oil prices, however, could come with a downside. As they work their way through the system, deflation could follow. Already, 10 of the 34 largest economies in the world have seen year-over-year declines in consumer prices. The risk is that deflationary expectations could follow, encouraging consumers to withhold purchases in anticipation of even lower prices.

If that happens, excess capacity and inventories would build, forcing prices down more. When buyers' suspicions are confirmed, they further delay consumption, in a vicious downward cycle. The result is little if any economic growth, as deflation-prone Japan has seen over the last two decades.

The losers from declining oil prices obviously include producers and oil-services companies, especially those that are highly leveraged.

DYI quick comment: Excellent time to dollar cost average into your favorite oil & gas mutual fund, our favorite is Vanguards Energy Fund symbol VGENX. If oil prices drop even lower this would only encourage me to buy more. If oil prices go as low as Gary Shilling is predicting $10 to $20 range lump summing would be recommended.

At that level look into:

Adams Natural Resources Fund (NYSE: PEO), formerly known as Petroleum & Resources Corporation, is one of the nation’s oldest and most respected closed-end funds, and is the longest-tenured closed-end fund specializing in energy and natural resources stocks.

Buy When There's Blood In The Streets

Baron Rothschild, an 18th century British nobleman and member of the Rothschild banking family, is credited with saying that "The time to buy is when there's blood in the streets."

He should know. Rothschild made a fortune buying in the panic that followed the Battle of Waterloo against Napoleon. But that's not the whole story. The original quote is believed to be "Buy when there's blood in the streets, even if the blood is your own."

This is contrarian investing at its heart - the strongly-held belief that the worse things seem in the market, the better the opportunities are for profit.Back to Gary Shilling:

U.S. shale-oil frackers are taking a hit, and yet they stubbornly refuse to leave the business. One reason is that well-drilling costs are also declining. Another is that oil prices are still above frackers' marginal costs, which encourages them to increase output to make up for falling revenue.

Employees in the U.S. oil- and gas-extraction industry make up just 0.14 percent of total payrolls, but they were paid an average of about $41 an hour in July -- almost twice what other U.S. workers are paid. Since late last year, jobs are down only 4 percent in the sector and weekly pay has declined just 3 percent. With another big leg down in oil prices, vacancy signs may soon appear in the once-booming North Dakota fracking fields.

Further drops in oil prices will add to the woes of African exporters Ghana, Angola and Nigeria. Oil exports finance 70 percent of Nigeria's budget. Ditto for economic basket case Venezuela, where the bolivar has collapsed from 103 per U.S. dollar in November to 701 on the black market. (The official rate remains a fanciful 6.29 to the greenback.)

Russia depends heavily on oil exports to finance imports and government spending. With Western sanctions over Ukraine squeezing the economy and Russian banks unable to borrow abroad to service their foreign debts, another drop in oil prices could precipitate a rerun of the country's 1998 default. The ruble has dropped to 66 per dollar from 49 per dollar in May, inflation is running at a 16 percent annual rate, and the economy contracted by 4.6 percent in the second quarter versus a year earlier.

With no other meaningful source of foreign exchange, Russia no doubt will continue to produce and export oil even if prices fall below marginal costs. And who knows what President Vladimir Putin might do next to divert domestic attention from this miserable situation?DYI QUICK COMMENT: It appears that Vlad has his eyes set on Syria along with their allies Iran to ramp up the on going Muslim civil war. To what end is unknown, except to extend Russia's reach, expensive and Russian blood, for only marginal gains in this war torn part of the world.

Back to Gary Shilling:

According to Shakespeare, the dying King Henry advised his son, Prince Hal, to "busy giddy minds with foreign quarrels."

"Energy stocks are already down substantially on oil price weakness, with stalwart Royal Dutch Shell off 35 percent over the past year.

Expect more punishment for speculators and investors who hold oil and related securities if prices drop toward my $10- to $20-a-barrel target. "

Persian Gulf stock markets have been hurt and will probably nosedive with further oil-price weakness, especially since they're dominated by retail investors who have used cheap credit to rack up sizable margin debt. The Saudi bourse was the region's top performer this year, partly in anticipation of its opening to foreigners in June. Still, it's down 10 percent for the year so far. Oil provides 90 percent of the Saudi government's revenue and 40 percent of gross domestic product.

The U.S. Federal Reserve has put off raising short-term interest rates until labor markets and inflation data are more to its liking, but it now seems to many that it will take action before the end of 2015. I believe the Fed will hold off on a rate hike until next year, at the earliest. But if it does move this year, and commodity prices tumble, China slumps and deflation sets in, it could soon wish it hadn't.

"The combination of all these forces may be the shock that precipitates the next global recession."DYI Comments: The U.S. stock and bond(junk bonds) are at nose bleed levels. Our favorite dividends as a unit of measurement the S&P 500 yield is 104% above its average. Using 6% dividend yield(17 price to dividends) as a possible secular bottom; would require a 64% drop in market prices. This could take more than one complete cyclical downward move to achieve this but it is still very doable in a one or two year crash. I have no crystal ball. All I do know is this market based on valuations and historical norms is way overvalued.

Not all is lost in this waiting game as oil & gas and precious metals mining shares are there now or in the process of being put on the give-away-table. Don't let fear drive you away from buying into two industry groups that will be with us for many years to come.

Updated Monthly

AGGRESSIVE PORTFOLIO - ACTIVE ALLOCATION - 9/1/15

DYI

No comments:

Post a Comment