Jeffrey Brown: To Understand The Oil Story, You Need To Understand Exports

Despite the attention-grabbing economic volatility that is grabbing headlines, it's important to keep our eye on the energy story firmly in focus. This is especially true as the headlines we regularly read about Peak Oil being dead " are "manifestly false" according to this week's podcast guest, petroleum geologist Jeffrey Brown.

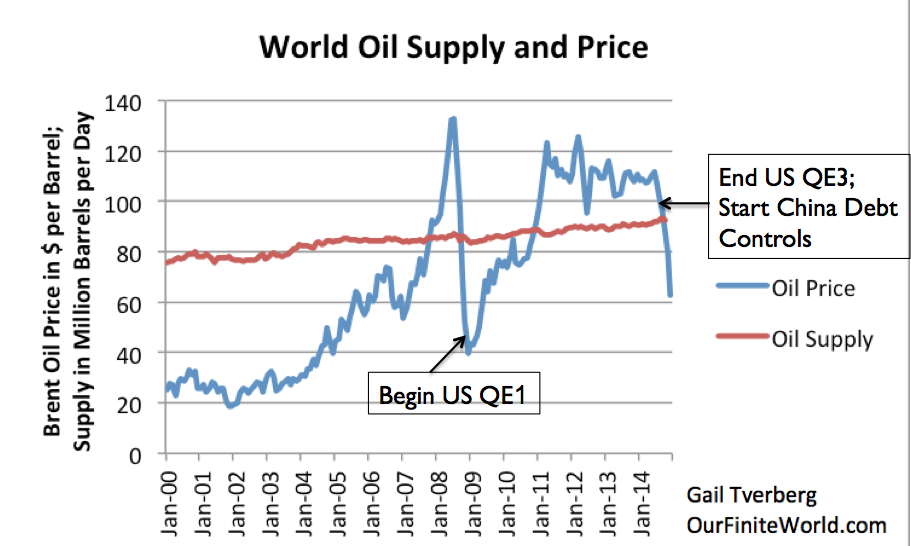

"As concerning as the fact that global oil production has plateaued over the past decade, despite trillions invested in trying to goose it higher,"

are Brown's forecasting model for oil exports. His Export Land Model shows how rising internal consumption can swing (and has swung) countries from major exporters to permanent importers within a dizzyingly short period of time:

I started wondering in late 2005 what happens to oil exports from an exporting country, given a production decline and rising consumption. And, so I just started, I just constructed a simple little model.

I assumed a production of about two million barrels a day or so at peak, consumption of one, and assumed production falls about 5% per year, basically what the North Sea did, and assumed consumption increases to 2.5% per year.

What the model showed was that exports, net exports would go to zero in only nine years, even though a roughly modest production decline.

So, the easy way to state it is giving an ongoing, inevitable decline in production, unless an exporting country cuts their domestic oil consumption at the same rate as the rate of decline in production, or at a faster rate, it’s a mathematical certainty that the net export decline rate, what they actually ship out to consumers will exceed the rate of decline in production. And, furthermore, it accelerates.DYI Comments: Time to buy the oil's! Dollar cost averaging ONLY for we don't know how low this geo - political soap opera is going to play out. The Saudis desire to increase market share by pumping to max capacity along with punishing their arch enemy Iran. The U.S. wants Iran & Saudis Arabia pumping oil to lower the price further to put a big hurt on Russia(and boost our economy). The war on Islamic terror has always been a side show for the State Department their goal from day one after the fall of the Soviets is to finish off Russia. Their hope is for Russia to lose the Caucasus, the Laplands, and parts of Siberia including their prize Pacific port of Vladivostok. This would also bring the Ukraine into NATO and a slim possibility of Belarus as well.

IT'S ALL ABOUT OIL! This would give an opportunity for American and European oil companies to move into these areas to secure oil and gas to continue to propel our economies. This is a temporary dip in price that may last a few years providing an excellent time to dollar cost average into your favorite energy fund. DYI's favorite is Vanguard's Energy Fund symbol VGENX with a great track record plus no load fund and their expense ratio of only 0.37%.

Oil and gas prices will recover as world production has plateaued(peaking process). With China and India modernizing their economies they will need oil and gas; hence the price will increase.

Don't let fear keep you from setting up future profits. The best time to buy is when prices are in the doldrums.

DYI

No comments:

Post a Comment