Toronto

Canada

Home Prices Drop

Total home sales in Greater Toronto dropped to 5,977 in June, the lowest level since 2010 and down 15.1 percent from the month prior, data from the Canadian Real Estate Association show. Average prices are down 14.2 percent since March -the fastest 3-month decline in the history of the data back to 1988-while the ratio of sales to new listings sits at its lowest level since 2009.

DYI: Is this

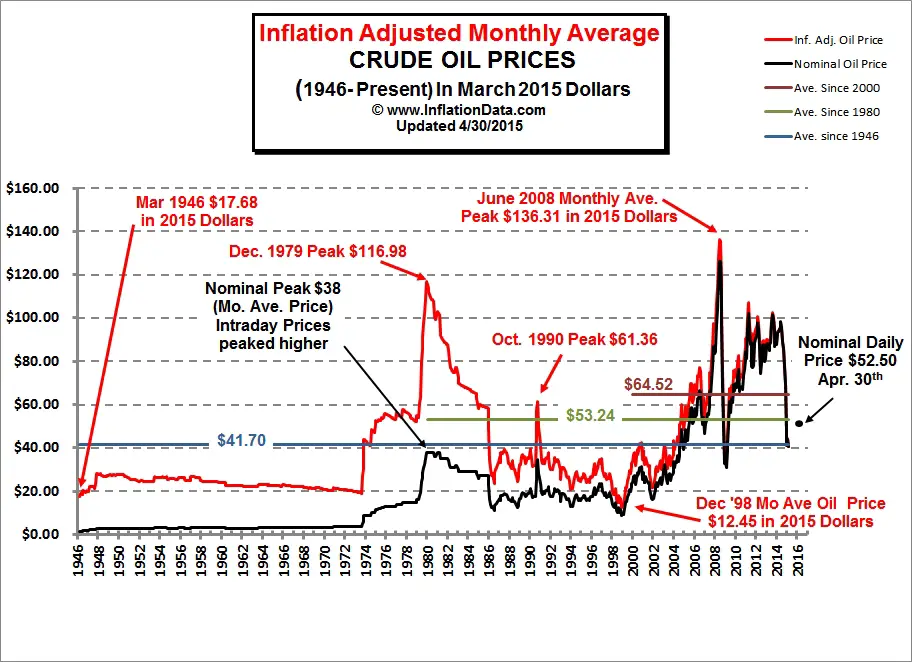

the long awaited Canadian debt/housing bust? Canadian real estate has been on a

tear since December of 1998 when oil prices bottomed at $12.45 per barrel (2015

U.S. dollars).

Also natural resource prices bottomed around

that time providing extra rocket fuel to the Canadian economy. Add on the last eight years of sub atomic low

interest rates setting the stage for a real estate mania extravaganza.

To make matters worse Canadian citizens have leveraged

up far greater than their U.S. neighbors.

Time will only tell if this is a hiccup or

the long awaited real estate crash. All

of the seeds are present for a crash.

However markets can and do remain far longer irrational than seemingly

possible and this has been the case for Canada.

My advice remains the same for Canadians sell your house yesterday, hold

onto the proceeds into ultra low risk investments and wait. Continue to build additional reserves for

when the smash arrives you will be in a bargain rich environment.

DYI

No comments:

Post a Comment