Interest

Rates Bottom

In 2012?

Deutsche: Is The US Headed For An Imminent Debt Crisis? Here Are The Signs

The thesis is simple and familiar: the United States is running a fiscal deficit and a current account deficit (i.e. "twin deficits") and relies on domestic and foreign investors to buy US Treasuries.

The bigger the fiscal deficit is the more Treasuries investors - including the Federal Reserve - need to buy. At the same time, the more Treasuries that have to be sold, the highest the interest rate all else equal... until something snaps (or unless an stock market crisis forces the Fed and investors to monetize/park cash in Treasuries).

This was, in a nutshell the grim message from the IMF's latest Fiscal Monitor Report, which warned that the US would be the only country with growing debt levels over the next 5 years.

BofA: The 10Y Treasury Is No Longer A "Safe Asset", Here's Why

At the end of his lengthy presentation to DoubleLine investors in January, Jeff Gundlach, who was aggressively pitching commodities at the time, a trade that has since returned double digits, made an interesting observation: he predicted that in the next recession "we won't see a bid for safety out of stocks and into bonds." In other words as stocks tumble we "won't see a bond market rally", which means that bonds will no longer be a "safe asset."

What’s driving the expansionary debt dynamics of the US? First and foremost, the increase in spending authority by $150bn (0.7% GDP) per year, for the next two years, coupled with lower individual and corporate tax rates (tax reform) will result in US budget deficits being greater than $1tr for the next 3yrs. Meanwhile, the Congressional Budget Office recently forecast that US federal debt (held by the public) will rise close to the WWII peak over the next decade.

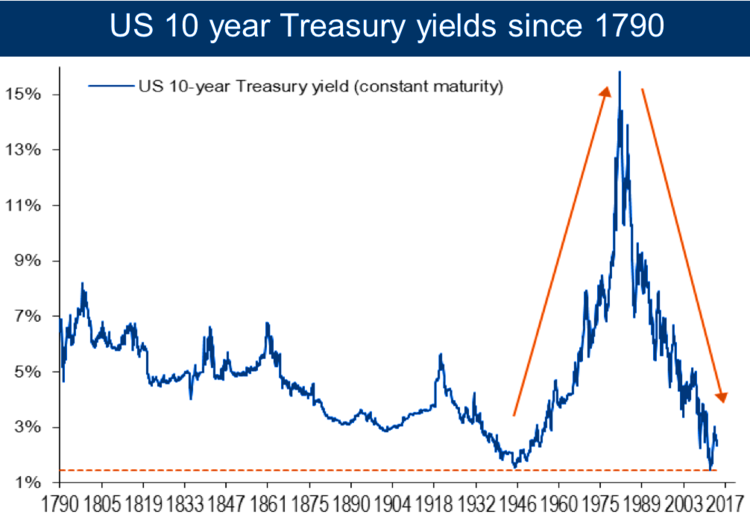

DYI: During any economic downturn the Federal

Reserve will step in and once again purchase Treasuries dropping interest

rates. In the meantime they’ll continue

to sell off 50 billion per month increasing the supply of bills, notes, and

bonds hence lifting interest rates. The Fed's will have ammunition for the next downturn and hopefully not have to

resort to negative interest rates. Of

course if we have a severe downturn which is possible due to our multitude of

economic imbalances negative rates will occur.

As our economy continues to move along I do

agree that rates will lift over time in a seesaw fashion only interrupted by recession(s). Unless a horrific economic smash occurs rates

as measured by the 10 year T-bond bottomed in 2012 at 1.4% from now on [in a

seesaw manner] interest rates will continue to rise as they did during the

great bond bear market of 1946 to 1981.

DYI

No comments:

Post a Comment