Mean

Regressing!

After 10 fat years for stock investors a lean decade is looming

According to Convoy’s data, stocks averaged a total annualized return of 13.2% thus far this decade, comfortably above the long-term average of 9.6%. While this was below four other decades — the best decade was the 1950s, when the average was 18.8%, followed by the 18.6% gain in the 1990s — equities fared better in terms of their excess return above interest rates.DYI: Future returns are determined by the level of valuations. The 1980’s and 1990’s had high returns once extreme overvaluation occurred returns were either sub par or at a loss for one or two of those ten years. When stocks bottomed out in 2009 valuations were slightly below their historical mean thus positive returns going forward the only reason they have been red hot our Central bank created a environment of sub atomic low interest rates conducive for speculation.

Shiller PE 10 as of 4-16-18 is 31.60

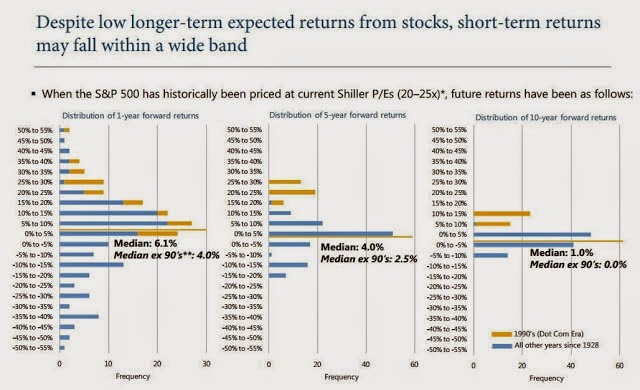

Below is an interesting chart showing future

returns based upon Shiller pe10 at the 20 to 25 level. Returns shorter term is determined

whether the investing public or institutions are willing to speculate for

higher returns or if sentiment has turned more cautious.

Going out 10 years markets will either be

pushed up or pulled down gravitating around their historical mean. Unless you believe markets have reached a permanent high plateau stocks will once

again come out of the clouds with sub par returns or losses over the next 10

years.

At Money Chimp an excellent calculating tool

to determine future returns. Putting in

the numbers our current PE10 at 31.60 regressing back to the mean of

16.85 with a current dividend yield of 1.90% total return for stocks purchased

or held – go to sleep like Rip Van Winkle – waking in 10 years is a sub par

0.50% average annual return. However markets

have been above their mean for years in order to create the mean valuation must

be above and below. Stocks could very

well land back to 10 or 12 times Shiller PE10. Using 12 times our return will be an average

annual return of negative 2.79% much more in line with DYI’s thinking.

DYI

No comments:

Post a Comment