Stock

Market Investor

Margin

Debt Reaches New High

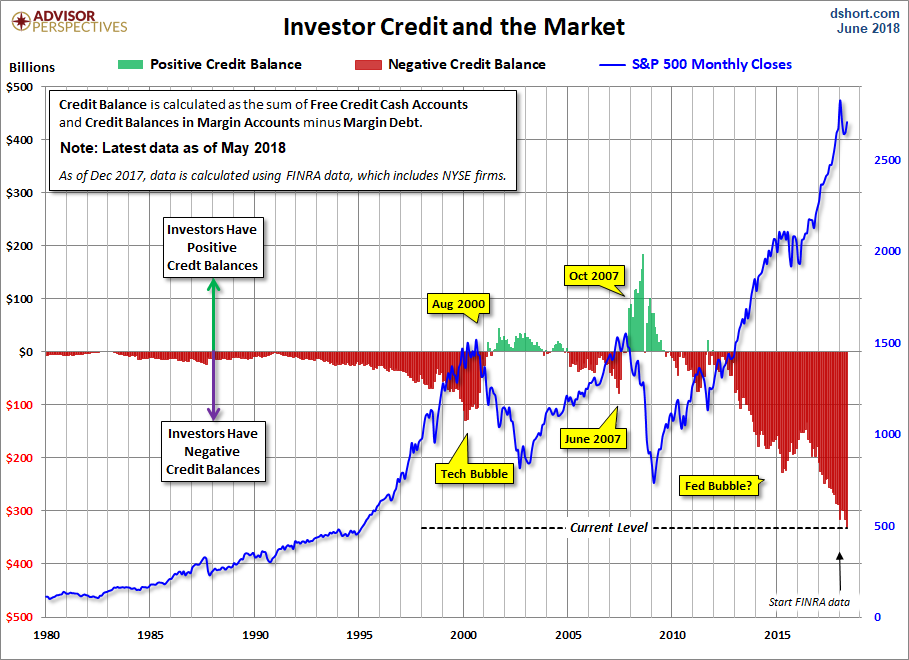

The world is standing at the edge of the financial abyss while most investors are entirely in the dark. However, specific indicators suggest the market is one giant RED BLINKING LIGHT. One of these indicators is the amount of margin debt held by investors.

What is quite surprising about the level of investor margin debt is that it has hit a new record high even though the market has sold off 2,500 points from its peak in February.

It seems as if investors no longer believe in market cycles or fundamentals.

Instead, the Wall Street saying that “This time is different” has become permanently ingrained in the market psychology.

For example, it doesn’t seem to matter to the market that Amazon makes no money on its massive online retail business. The only segment of Amazon’s business that made a decent profit last quarter was from its Cloud hosting services.

Regardless, the economic and financial markets today are setting up for one heck of a fall. According to FINRA, the Financial Industry Regulatory Authority, investor margin debt reached a new high of $669 billion in May:

I stated in several articles and videos that the Dow Jones Index was not likely to surpass its high, but remain in a trading range. So far, this is exactly what is taking place in the market. Although, I am surprised that investors piled more margin into this market knowing that we are overdue for a massive correction… at the very least.

DYI: There is nothing more I can add to this

article as the author is spot on in his analysis. When this massively overvalued beast of a

stock market finally begins its multi month correction DYI expects from peak to

trough of around 60% to 75% decline.

This will shake everyday investors [401k, IRA’s, stock mutual funds, stock

brokerage accounts etc.] to their very bone.

At the upper level of the decline many will swear off stock investment

for the remainder of their lives.

Be

as that may be, DYI will only commit money to equities as valuations improve

and only at a valuation level commensurate with its downside risk/upside gain

possibility. This is measured by our

formula based upon valuation above or below its mean to determine the percentage

in stocks. Today stocks valuation are so

high my model portfolio has been “kick out” of stocks and rightfully so! So hang onto your hats and cash as The Great

Wait Continues and eventually will turn into The Great Crash**!

Updated Monthly

AGGRESSIVE PORTFOLIO - ACTIVE ALLOCATION - 7/1/18

**With

the market off 2,500 from the top of the Dow we may have begun The Great

Crash. Do I know for sure? Good Lord NO!

However at these elevated levels and massive margin debt it is a

possibility to be entertained.

DYI

No comments:

Post a Comment