Real Estate

(Buyer Beware)

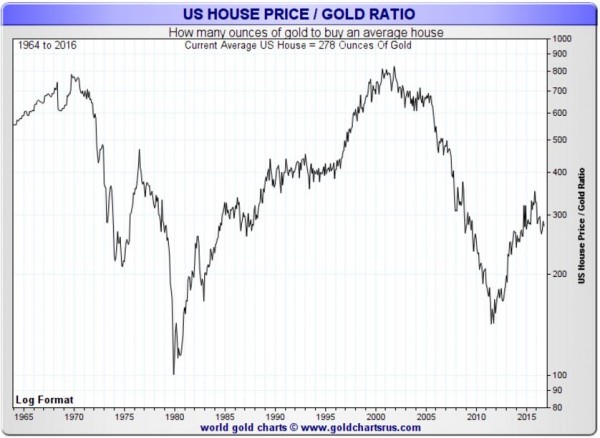

As of 3-15-18 R.E./Gold Ratio 182 to 1 (Rounded)

DYI: Just

as the Dow/Gold Ratio helps us maneuver between stocks and gold the Real

Estate/Gold Ratio will give you a picture of valuation in order to make

informed decisions [between R.E. & Gold]. Currently the R.E./Gold Ratio is at 182 to

1. 182 ounces of gold to purchase the

U.S. median priced single family house as reported by the National Association of Realtors. Latest statistics medium

priced home is $240,500 divided by latest gold price from Yahoo.com is $1320 equals

182 (rounded) ounces.

The ratio has an interesting historical track

record for identifying turning points in long-term gold and real estate price

trends. When exactly is one of the assets "cheap" and what is

"expensive"? Answering that question is where the Housing/Gold Ratio

is quite useful. As there is no dollar component in the ratio itself, inflation

concerns drop out, and we are left with the value of two of the most popular

tangible investments relative to each other.

What this chart is telling us residential

single family homes median U.S. cost is moderately priced as compared to

gold. I’m searching the net for the

average R.E./Gold Ratio (no luck so far).

However, just eye balling off the chart looks around 350 to 1. This places R.E. right where you would expect;

costs are no longer outrageous but housing is no super bargain as illustrated

during the early 1980’s. Simply put

moderately priced.

Intervention:

- Massive World Wide Central Banks

- World Wide Fiscal Spending

All of the Kings men – central bankers and

politicians – have attempted with some degree of success in pumping up real

estate prices; all at the expense of massively distorting the U.S. economy. As with any speculative event this will

eventually end in a trail of tears. In

order to stem off real estate defaults [and save the banks asses from

bankruptcy] interest rates were pounded down to sub atomic low levels and in

Europe to negative territory! Outrageous

deficit spending propelling our Debt to GDP to 105%! As this continues to increase someone is

going to blink and demand higher interest rates. Unless we experience a huge downturn in the

economy rates have most likely bottomed in 2012 with our bell weather 10 year

Treasuries at 1.4%!

Real Estate is a Function of Interest Rates

When interest rates go up the price of real

estate goes down and conversely when interest rates go down the price of R.E.

goes up.

This can be interrupted either way only by

through a depression or a scorching red hot economy. These are very sparse events such as the 1930’s

Great Depression or the Great Recession of 2008 – 2012; the Roaring 1920’s;

late 1960’s; and lastly the late 1990’s.

For the most part R.E. once these hot and cold economies pass prices

will revert to the function of interest rates.

As of 3-15-18...2.81%

The Party is Over!

Unless the U.S. experiences an economic smash

driving interest rates lower possibly negative the party is over for declining

rates. The days of making money in real

estate hand over fist is over on an across the board basis. As we move through the years; rates will

rise. No doubt the Fed’s will fight the

rise as rates increase in a saw tooth manner.

This will put a depressant downward effect on after inflation adjusted

prices. R.E. will once again be all

about location and cash flow. There will

be cities due to some positive economy will experience a short term flurry [lasting

briefly] of speculative excess but those will be an outliner and not the

general U.S. trend.

My suspicion we will see R.E. bottom at the

depths shown on the R.E./Gold Ratio of the early 1980’s. At that time sell your gold and purchase real

estate either physical or through an REIT.

DYI

This blog site is not a registered financial advisor, broker or securities dealer and The Dividend Yield Investor is not responsible for what you do with your money.

This site strives for the highest standards of accuracy; however ERRORS AND OMISSIONS ARE ACCEPTED!

The Dividend Yield Investor is a blog site for entertainment and educational purposes ONLY.

The Dividend Yield Investor shall not be held liable for any loss and/or damages from the information herein.

Use this site at your own risk.

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

No comments:

Post a Comment