Gold and Silver Shine During the Race to Debase

The ECB remains trapped and once Draghi told the markets to be prepared for more easing measures into 2020, the euro briefly fell to a two-year low against the dollar. More than ten years of quantitative easing has utterly failed, so now Draghi is unable to return rates to normal levels without bankrupting the ECB and cause all 28 member states of the EU to pay more in interest.

Next Wednesday the Federal Reserve is expected to deliver its first interest rate cut since 2008. According to the CME’s FedWatch tool, there is a 100% probability that there will be a rate cut announced at the FOMC meeting on July 31st. The tool indicates there is a 76.5% probability that the rate cut will be 25-basis points (1/2%), and a 23.5% probability that the rate cut announced will be 50-basis points (1/4%).

DYI Quick Comment: Time for all Presidents to gun the economy –

lower interest rates – and rune for reelection.

With global growth slowing, central bankers around the world have taken a more dovish turn toward monetary stimulus which has been weakening their local currencies. The Fed is the most recent central bank (and the biggest) to telegraph lower interest rates and a weaker dollar.

This is one of the main reasons that global traders have turned to gold as a new store of value during this “race to debase”.

The price of gold quoted in Aussie Dollars continues to make all-time highs and has been joined there recently by three other major currencies. Gold priced in the Japanese Yen, Canadian Dollar, and the British Pound are all trading at their respective all-time highs. The euro has been this year's weakest currency thus far, so the price of gold quoted in euros is doing even better, as the chart of gold always looks stronger when quoted in a weaker currency.

The most important recent development in the precious metals complex is that gold is now trading as more than just a commodity. When global traders lose confidence in their currency, they often turn to gold as an alternative store of value.

The main message is that gold has now become the world's strongest currency, as well as one of its strongest commodities.

For the first six weeks of this gold move, silver and many of the juniors have lagged gold and its miners considerably. Then last week, silver began running higher, significantly outperforming gold. But some of the junior development and earlier stage exploration stocks were still stuck in the mud until this week.DYI Quick Comment: DYI’s model portfolio [see below] is well positioned to take advantage of a precious metals move to the upside.

Updated Monthly

AGGRESSIVE PORTFOLIO - ACTIVE ALLOCATION - 07/1/19

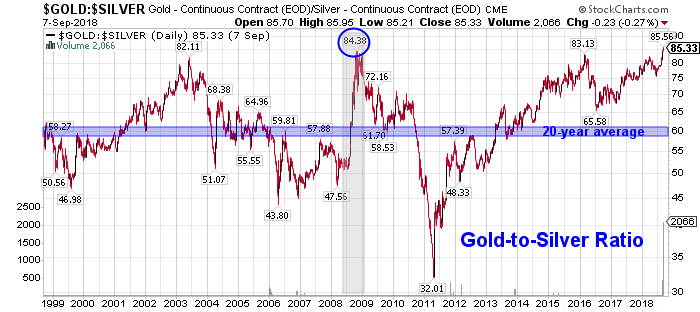

**Tocqueville Gold Fund TGLDX is a pure play 100% junior gold mining gold fund. Vanguard's Global Capital Cycles Fund maintains 25% in precious metal equities the remainder are companies they believe will perform well during times of world wide stress or economic declines.For those of you who buy bullion [I purchase the miners and bullion] concentrate on silver as the gold to silver ratio is with silver being the better choice [see chart below].

As of 7/29/19 Gold/Silver Ratio is:

87 to 1

Till

Next Time

DYI

No comments:

Post a Comment