Housing

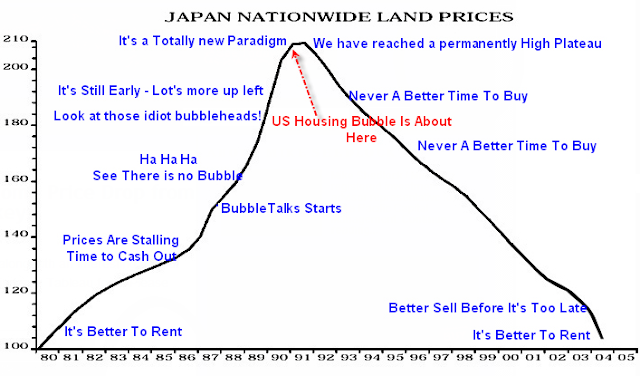

Bubble Trouble

Here We Go Again!

The

Great Melt!

DYI: Household

real estate will not be in a crash mode; it will be what I call The Great

Melt. Boomers who are desperate for

money have been slowly selling off their house once they have exhausted all of

their stocks and bonds. Of course for

every seller there must be a buyer. The

Millennials and Cyber generation have very little money and income to purchase

these homes despite the low interest rates.

When household real estate begins to go south [along with the economy]

the Fed’s will once again drop rates.

Most likely this time we will experience negative rates. This will hold property prices up for a while

but as Boomers in need of money will place more and more real estate on the

market driving prices lower. Over the

next 25 years [until Boomers sell off their properties] household real estate

will be in decline or what I call The Great Melt!

No comments:

Post a Comment